MODEL ANSWER>>>

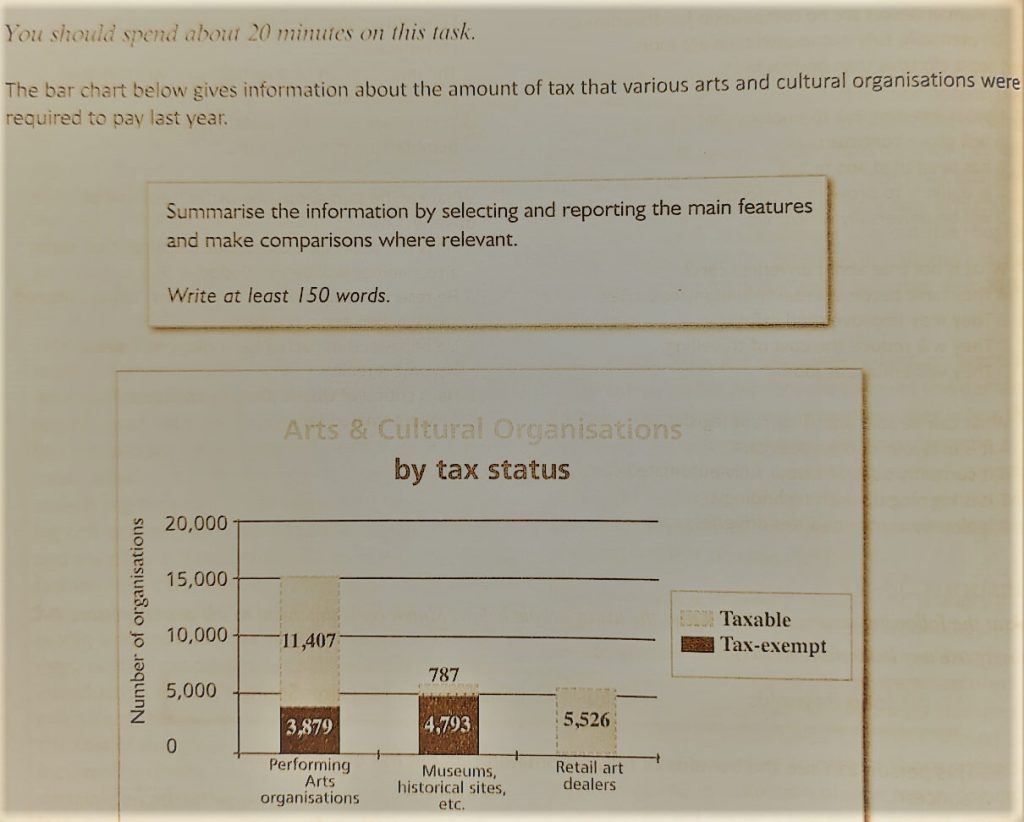

Information on the number of arts and cultural organizations required to pay tax that last year is depicted in the bar chart.

Overall, it is clear that most number of museums and historical sites were exempted from the tax, while most performing arts organizations had to pay tax in the particular year.

As per the chart, out of the total 15,000 performing arts organizations, majority were liable to pay tax last year. The number of such organizations was 11,407, which was the highest among the three genres of organizations. The privilege of tax-exemption was enjoyed by exactly 3,879 organizations of this type.

On the other hand, most museums and historical sites were exempted from tax. When exactly 4,793 such organizations were not required to pay tax, just 787 of those had the liability to pay tax in the given year.

It is interesting to note that, of the total 5,526 retail art dealers, none were exempted from tax.

Word count: 152